Discounted payback period financial calculator

The longer the payback period of a project the higher the risk. Formula for Retention Ratio.

Payback Period With Baii Plus Note With Professional Ba Ii Plus Youtube

Internal Rate of Return - IRR.

. You have to determine the payback period of the project. Get 247 customer support help when you place a homework help service order with us. Investment is the dedication of an asset to attain an increase in value over a period of time.

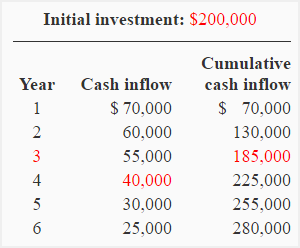

Estimates the period of time will take an investment to generate positive cash flows that cover its initialtotal cost. Suppose XYZ ltd had invested 200000 in Project Z. Net Present Value - NPV.

All in One Financial Analyst Bundle 250 Courses 40. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period. Alternatively another method to calculate the YoY growth is to subtract the prior period balance from the current period balance and then divide that amount by the prior period balance.

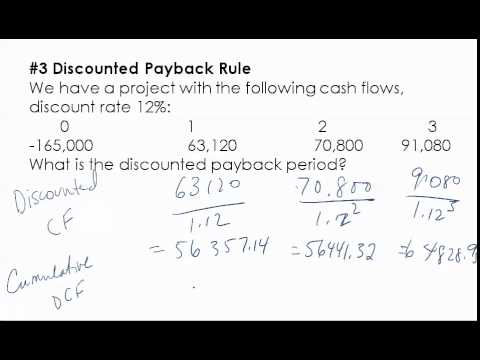

For Example XYZ Inc. Is considering buying a machine costing 100000. Investments with higher cash flows toward the end of their lives will have greater discounting.

If you are someone who needs date accurate results with either regular or irregular cash flows loans payments deposits withdrawals investments this is the calculator you. NPV is used in capital. The formula adds up the negative cash flows after discounting them to time zero using the external cost of capital adds up the positive cash flows including the proceeds of reinvestment at the external reinvestment rate to the final period and then works out what rate of return would cause the magnitude of the discounted negative cash flows at time.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. You can use the following Calculator. Almost all aspects of corporate finance are part of capital budgeting.

Resolves any time value of money problem like estimating the future value FV present value PV annuity payment PMT return rate or no. YoY Growth 30 million 25 million 25 million 200. In the formula the -C 0 is the initial investment which is a negative cash flow showing that money is going out as opposed to coming in.

Payback Period. Discounted Payback Period Calculator. Option 2 which has the highest sum of non-discounted cash flows does in fact not even yield the required return rate of 12.

Wikipedia defines the MIRR as. Real Estate Industry - Real Estate Financial Modeling The real estate industry is one of the biggest industries that is continuously growing. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

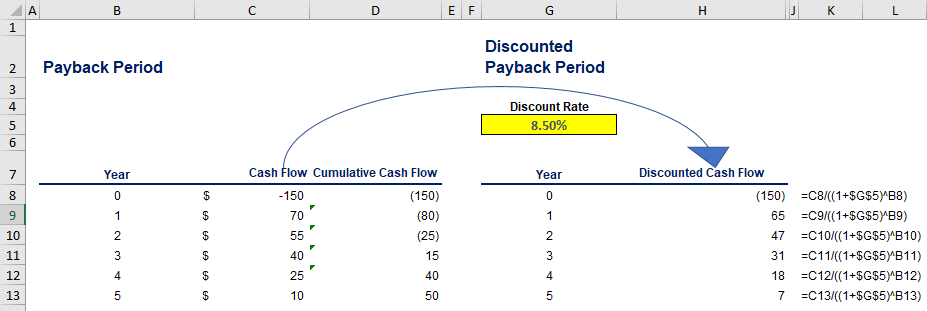

Discounted payback period will usually be greater than regular payback period. Under either approach the year-over-year YoY growth rate comes out to 200. Lets try to understand the concept of the payback period using an example.

10mm Cash Flows Per Year. Considering that the money going out is subtracted from the discounted sum of cash flows coming in the net present value would need to be positive in order to be considered a valuable investment. For example if a capital budgeting project requires an initial cash outlay of 1.

Or year during which an organizations financial statements are prepared for external use uniformly across a period of time in order for the general public and users to interpret and evaluate the financial statements. We also provide you with Payback Period Calculator with downloadable excel template. With a payback period of 471 this option achieves a full amortization in less than 5 years which can be a reasonable time horizon for many organizations.

Formula for Preferred Dividend. Example of Payback Period. Entering the required values will prompt the discounted payback period calculator to provide you with the Payback Period and the Discounted Payback Period.

A corporate financial analysts job is to learn how to assess various operational projects or investments. Discounted Payback Period Calculator. The payback period calculates the length of time required to recoup the original investment.

Investment requires a sacrifice of some present asset such as time money or effort. Get all the latest India news ipo bse business news commodity only on Moneycontrol. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a breakdown of all the tax costs that will be taken with consideration to.

The discounted payback period is a capital budgeting procedure which is frequently used to calculate the profitability of a project. The return may consist of a gain profit or a loss realized from the sale of a property or an investment unrealized capital. Internal rate of return is a discount.

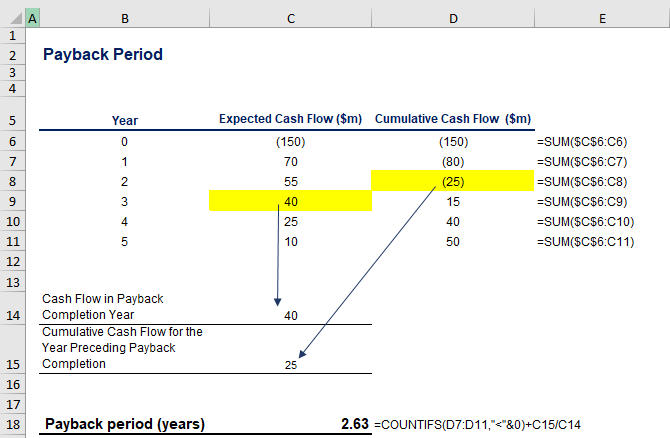

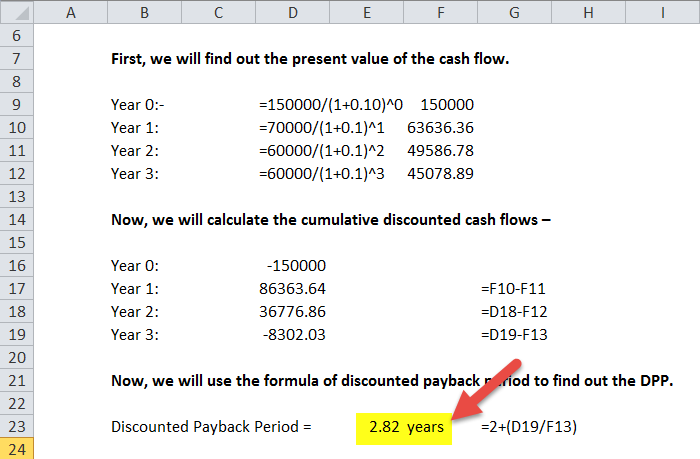

The payback technique states how long it takes for the project to generate sufficient cash flow to cover the projects initial cost. First well calculate the metric under the non-discounted approach using the two assumptions below. Payback Period 3 1119 3 058 36 years.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Typically the stated coupon rate of a bond remains the same until its maturity however the expected rate of return of the investors fluctuates during the period based on the ongoing market trend. Payback Period Example Calculation.

Accounting rate of return. When deciding whether to invest in a project or when comparing projects having different. Generating billions of dollars in revenue every year even though there were times where the economy in real estate fluctuates it is still undeniable that this industry is offering a lot of opportunities for startups to turn a profit.

The project earns a return of 40000 at the end of each year. The discounted payback period of 727 years is longer than the 5 years as calculated by the regular payback period because the time value of money is factored in. In finance the purpose of investing is to generate a return from the invested asset.

As such bond investors set the bond prices higher or lower until its current yield is equal to that of other bonds with a similar level of risk. PBP 5 years ie. One of the simplest investment appraisal techniques is the payback period.

Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Internal Rate of Return IRR is a metric used in capital budgeting to estimate the profitability of potential investments.

4mm Our table lists each of the years in the rows and then has three columns. Interpretation of Payback Period.

Undiscounted Payback Period Discounted Payback Period

What Is The Discounted Payback Period 365 Financial Analyst

Payback Period Formula And Calculator Excel Template

Ba Ii Plus Calculate Payback Period Npv Irr Pi Youtube

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Discounted Payback Period Example 1 Youtube

Computing Discounted Payback Period 8 3 Youtube

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Formula And Calculator

Discounted Payback Period Formula And Calculator

Payback Period Formula And Calculator Excel Template

Discounted Payback Period Formula And Calculator

Discounted Payback Period Formula With Calculator

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

What Is The Discounted Payback Period 365 Financial Analyst